In many claims, insurers make use of your borrowing from the bank to help influence their car insurance advanced

Large Insurance costs

They are able to pull recommendations out of your credit history to give a card-established insurance score, like credit ratings. If you have less than perfect credit if any borrowing, youre expected to spend high insurance costs.

Adopting the discussion inside getting good discriminatory habit, particular states possess prohibited the means to access borrowing from the bank for the cost car insurance, along with California, Hawaii, Maryland, Massachusetts, Michigan, Oregon and you will Utah.

A way to Make Credit Out-of Abrasion

Even after zero credit score or past higher-focus bills, there are ways to go into the system and start building borrowing from the bank otherwise working to resolve a formerly broken credit rating. And you may this new scoring models and you will technologies are and make borrowing from the bank a lot more obtainable than ever before. Below are a few methods start building, or rebuild, your borrowing:

Apply to Regional Groups

If you believe unnerved otherwise overwhelmed from the borrowing from the bank procedure, regional credit bureaus and you can area-based organizations are perfect tips to have assistance. They’re able to functions you to definitely-on-one to you to offer economic literacy units and you will info, provide choices to obtain borrowing from the bank, which help you make a confident credit history.

Society Invention Loan providers, or CDFIs, are a great place to start. These may feel financial institutions, credit unions, or any other personal creditors offering accessible economic characteristics inside financially vulnerable communities. To get an excellent CDFI near you, look at the Options Financing Network’s CDFI locator device.

You could must consult a card therapist regarding the your bank account, especially if you happen no credit check payday loans Atlanta GA to be carrying debts. 100 % free or affordable borrowing from the bank counseling is often given compliment of nonprofits, and certainly will render a range of choices, away from expert advice so you’re able to financial obligation government agreements. The new Federal Base for Borrowing Guidance and the Economic Counseling Association away from The united states are fantastic resources to find a reputable credit specialist.

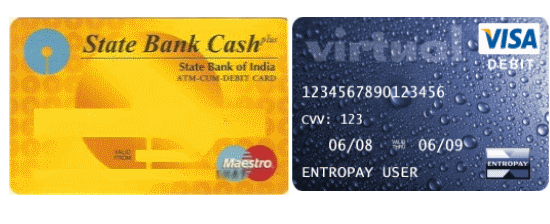

Secure Handmade cards

Building borrowing regarding scratch, otherwise reconstructing borrowing of past errors, is each other you’ll for those who start reduced towards the proper financial devices.

Secured handmade cards are simpler to be eligible for than simply really standard playing cards. That’s because, rather than becoming tasked a credit limit abreast of recognition, you’ll end up necessary to spend an effective refundable bucks deposit when you discover your own credit, which will act as guarantee and you will protects the brand new issuer against one unpaid charges. The minimum shelter put called for is frequently around $200-$3 hundred, and you will usually will act as their card’s borrowing limit. After you introduce a routine off uniform costs, of many issuers have a tendency to refund the defense deposit, and may also offer so you’re able to posting you to definitely a keen unsecured cards.

But before your sign-up, make sure to have the cash to expend brand new put initial, and study your cards contract very carefully which means you learn what is requested of you just like the a good cardholder.

There are even cards possibilities you will be qualified to receive without a safety put. These notes are designed to be more obtainable and rehearse an choice recognition processes, so they don’t require an everyday credit history so you can be considered.

Eg, this new Petal 1 Zero Yearly Percentage Visa Charge card granted because of the WebBank, Representative FDIC can use your earnings, offers and you may expenses habits said on your own application which will make a great Dollars Get to determine your own acceptance unlike your credit score. It works just like a frequent mastercard. The latest Tomo Charge card is an additional alternative that will not thought borrowing records for the recognition process, rather counting on financial advice you render from the software. But in lieu of a normal credit, the latest Tomo credit needs you to definitely generate a week repayments by way of an autopay program you to suppresses you from holding any balances.

Credit Builder Money

A card builder mortgage is created specifically so you’re able to boost your credit score. Just after recognition, the lending company holds the amount borrowed – essentially from the directory of $300 in order to $1,000 – in the a bank checking account when you build money over a length generally speaking put on 6 to help you a couple of years, according to perception from the CFPB. Your financial reports your own fee records for the credit bureaus so you can help you help make your credit rating, and you also, consequently, generally receive the money simply once you afford the mortgage within the full.